- MENLO GROUP

- 480.525.5362 (Call or Text)

- 480.535.5854

- info@menlocre.com

- Grafton Milne, Designated Broker

- Owner Portal | Tenant Portal

Eight Steps to Start a Dental Practice

August 8, 2023

Menlo Book Club: Positive Intelligence

September 20, 2023

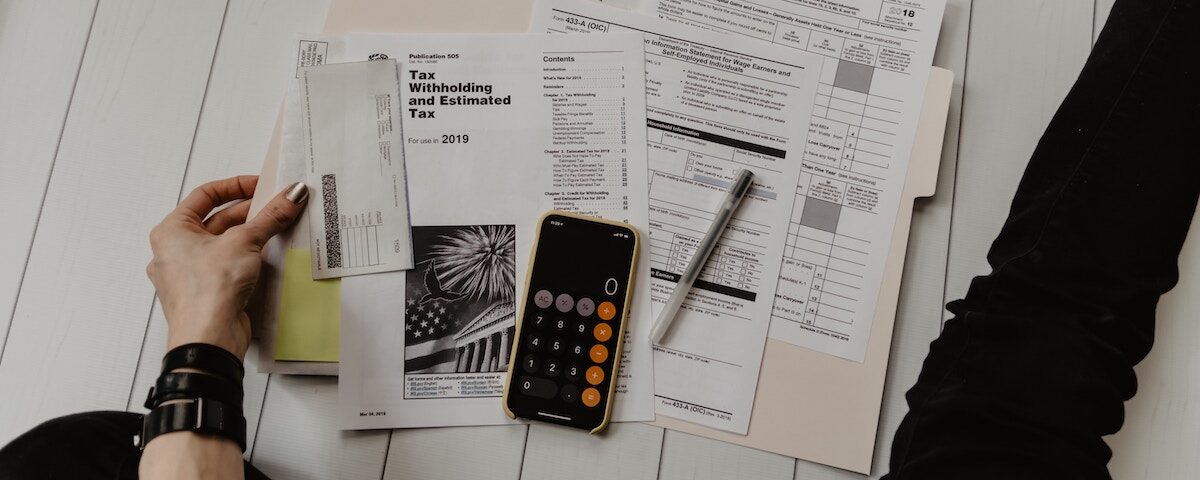

When it comes to commercial real estate investing, there are many strategies to optimize your returns and manage your tax liabilities. One such strategy that has gained popularity among investors is the 1031 exchange. This mechanism enables you to defer capital gains taxes and potentially build wealth more efficiently.

What Is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred transaction. It enables real estate investors to exchange one investment property for another of a similar nature. In other words, the proceeds from the sale are reinvested into a property also intended for business or investment use. As a result, investors defer capital gains taxes and recapture depreciation on the transaction.

In 1921, the United States Congress first authorized 1031 exchanges to encourage citizens to reinvest in business assets. The regulations have been updated over the years, with the most recent changes being made in 2001.

What Are the Benefits of a 1031 Exchange?

The primary advantage of a 1031 exchange is the ability to defer capital gains taxes that would typically be due upon selling an investment property. Investors are able to reinvest the entire sales proceeds into a new property and maximize potential returns.

By deferring taxes, investors can allocate more funds towards acquiring a higher-value replacement property. This potential for leveraging can lead to increased wealth accumulation over time. A 1031 exchange also offers the opportunity to strategically diversify your real estate portfolio by exchanging properties in different locations or asset classes.

What Key Terms Do You Need to Know?

A qualified intermediary is a neutral third party used to facilitate 1031 exchanges. The property sold is referred to as the relinquished property, while the property purchased is the replacement property.

The term like-kind refers to properties of the same nature, even if they differ in terms of location, quality or factors. Most real estate is like-kind to other real estate. For example, an office building could be exchanged for a rental duplex or a retail center could be exchanged for farmland.

Who Is Eligible for a 1031 Exchange?

To be eligible for a 1031 exchange, the person or entity must pay U.S. taxes. Individuals, partnerships, S-corporations, C-corporations, LLCs and trusts would all be included. However, the same individual or entity must sell the relinquished property and purchase the replacement property for a valid exchange.

How Are Funds Handled in the Exchange?

During a 1031 exchange, neither the taxpayer nor their agents can receive or control the funds from the sale of the relinquished property. If the taxpayer ever has direct or indirect access to the funds, the 1031 exchange is not valid. For this purpose, a qualified intermediary is used to hold the proceeds from the relinquished property sale until it is time to transfer the funds for the purchase of the replacement property.

If you’re considering a 1031 exchange, you should work with experienced professionals who can guide you through the process and ensure compliance with IRS regulations. Contact our team to get started.