- MENLO GROUP

- 480.525.5362 (Call or Text)

- 480.535.5854

- info@menlocre.com

- Grafton Milne, Designated Broker

- Owner Portal | Tenant Portal

1031 Exchange Rules and Requirements

September 20, 2023

Self-Managing vs. Hiring a Commercial Property Management Company

November 8, 2023

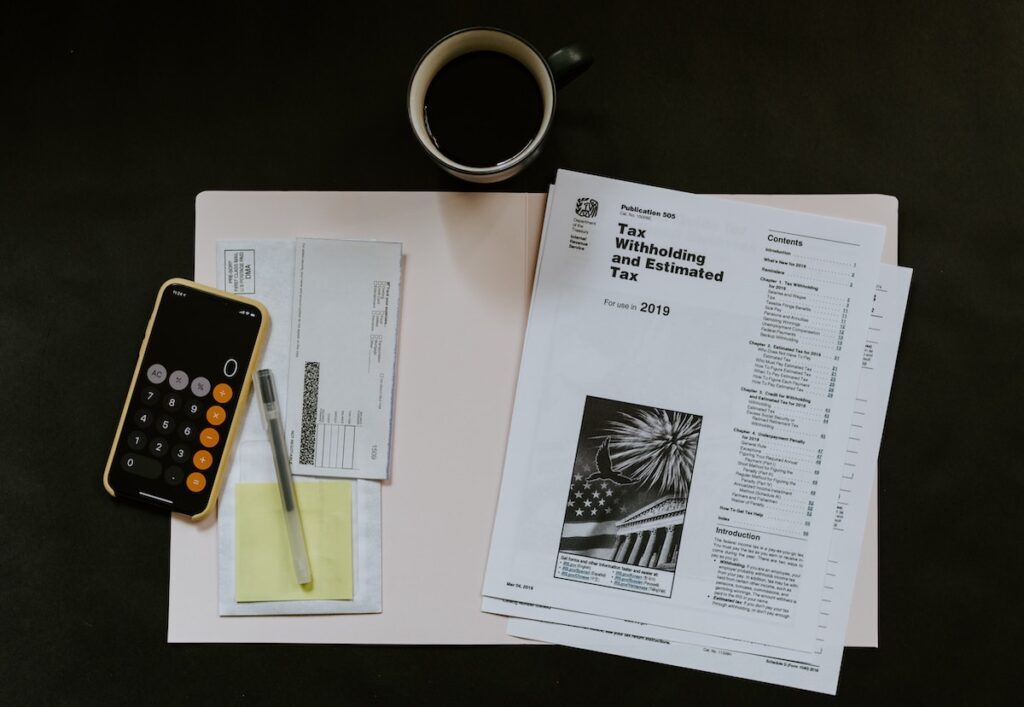

A 1031 exchange, also known as a like-kind exchange, is a valuable tax-deferral strategy that enables real estate investors to sell one property and acquire another without incurring immediate capital gains taxes. However, not every real estate transaction qualifies for this tax-saving mechanism. In this blog post, we’ll explore the essential eligibility criteria that determine whether you would qualify and benefit from a 1031 exchange.

To get started, here is simple guide that can help determine if your situation qualifies for a 1031 exchange and if an exchange is the best option for your upcoming real estate transaction.

- You (or your entity) pay taxes in the United States.

- Your tax strategies involve deferring your tax liability.

- Your goals are to maximize cash flow and long-term growth.

- You are selling “real property” that has been held for business or investment use.

- You plan to reinvest the full sale proceeds into another property that will also be held for business or investment use.

- You have not yet closed on the sale of your property.

- You feel confident in your ability to quickly identify and close on a replacement property in your desired markets.

- You have a team of professionals (tax advisors, commercial real estate advisors, lawyers, lenders, etc.) ready to support you in your exchange.

On the other hand, here are a few scenarios that may disqualify or deter you from a 1031 exchange.

- You (or your entity) don’t pay taxes in the United States.

- You are not selling “real property” or the real property you are selling hasn’t been held for business or investment use.

- You plan to reinvest the full sale proceeds into a second home for yourself.

- You have already sold your property and received the proceeds.

- You want to quickly increase your liquidity rather than reinvest into another property.

- You are interested in acquiring property in competitive markets and don’t feel confident that you can identify and acquire a replacement property within the required timeframes (45 days to identify potential replacement properties and 180 days to close on the acquisition).

- You don’t have a team to support you or your team isn’t familiar with the intricacies of 1031 exchanges.

These checklists should give you a good idea whether a 1031 exchange is the right fit for your situation or not. If you determine a 1031 exchange is right for you, Menlo 1031 stands ready to help. Contact us to get started.