- MENLO GROUP

- 480.525.5362 (Call or Text)

- 480.535.5854

- info@menlocre.com

- Grafton Milne, Designated Broker

- Owner Portal | Tenant Portal

Menlo Book Club: Adapt

May 22, 2020

Property Zones FAQ

July 15, 2020by Menlo Group President Tanner Milne, MBA, CCIM, SIOR

Many professionals who own their own businesses also own their real estate. These owners may lack a clear exit strategy for their asset. One option for property owners is to sell the property and then immediately lease the space from the new owners. This type of transaction is called a sale-leaseback.

Over the past few years, we have completed dozens of sale-leaseback transactions for our clients. In many cases, this process has resulted in better-than-expected liquidity events.

Sale-leaseback transactions provide many benefits to property owners, including the following:

1. Set their own lease terms

Since the seller of the property will become the tenant, the seller can determine the lease terms before engaging in discussions with a buyer. The tenant has the possibility of negotiating non-standard terms that will best benefit their business. In most cases, the buyer will want to ensure lease terms are in line with the current market.

2. Retain control of the location

In many situations, the location or interior improvements to the building are critical to the specific business. A sale-leaseback enables the business to maintain similar control of the location and property.

3. Gain greater value from the real estate

We have seen that in most sale-leaseback transactions the property owner obtains 20 to 40 percent more value by completing a sale-leaseback instead of selling a vacant property. In addition, a sale-leaseback transaction unlocks 100 percent of the value at the time of the sale. This differs from refinancing options where a property owner may capitalize up to 80 percent of the loan to value.

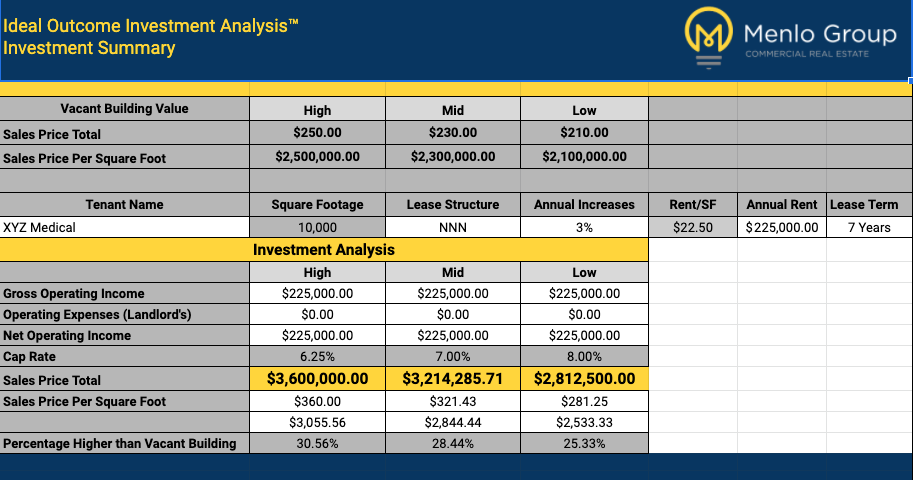

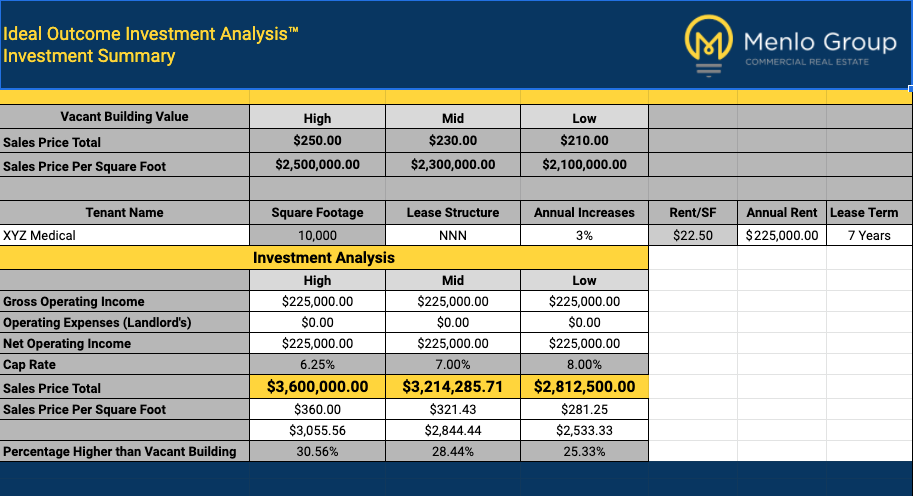

To illustrate a sale-leaseback transaction, let’s consider a 10,000 sq. ft. medical building. As shown in the following analysis, the seller could sell the property for 25 to 30 percent more as a sale-leaseback than as a vacant building.

*All deal variables (lease rate, length of lease term, capitalization rate, etc.) are market specific and should be reviewed with an industry expert.

The buyer also benefits from a sale-leaseback transaction. The purchase provides a built-in tenant and a predictable monthly income. Longer leases and reliable tenants are most attractive to potential investors.

A sale-leaseback is a great option to convert your equity into cash. To discuss your specific situation, reach out to a member of our landlord/seller representation team.